Market Cap

$4,401,666

Liquidity

$452,776

Holders

3,614(Top 10: 22.14%)

Blockchain

Solana

Contract Address

3hflqhtf5hr5dybxh6bmtratm9qzstveguma8gx6pump

AGE

145 days (Jan 14, 2025)

DEXes

Raydium, Meteora, Pumpswap

About buidl

Narrative is being generated, estimated waiting time is 1 minute

buidl (buidl) is a 145 days old token on the Solana blockchain. Current price: $0.004401 (-1.62% 24h). Market cap: $4,401,666. Liquidity: $452,776. Contract: 3hflqhtf5hr5dybxh6bmtratm9qzstveguma8gx6pump. Tracked on CoinGecko, Dexscreener. Traded on Raydium, Meteora, Pumpswap.

Key Factors & Recent Activity 2025-06-09T08:26:38

- Big news: BlackRock's backing makes moves on Solana.

- Their RWA fund brings fresh attention to BUIDL.

- Token’s multichain plans hint at real-world asset use.

- Trading shows steady volume but notable price swings.

- Some volatility means risks can pop up unexpectedly.

- Whales might step in, so keep an eye on sudden moves.

Disclaimer: Information provided is for general purposes only and not financial advice. Meme tokens can be highly volatile. Always do your own research (DYOR).

Visit Official Website →buidl/SOL Price Chart

| Timeframe | Price Change | Volume (USD) |

|---|---|---|

| 5 Min | -0.34% | $551.97 |

| 1 Hour | +3.74% | $9,589.77 |

| 6 Hours | -4.15% | $70,861.85 |

| 24 Hours | -1.62% | $417,541.71 |

Statistics

Market Cap

$4,401,666

Volume (24h)

$420,850.73

Fully Diluted Valuation (FDV)

$4,401,666

Circulating Supply

999,913,019

Total Supply

999,913,019

Max Supply

999,913,019

Holders

3,614+

All Time High (ATH)

N/A

All Time Low (ATL)

N/A

Buyers & Sellers Overview

| Timeframe | Net Buyers | Total Traders | Buyers | Sellers |

|---|---|---|---|---|

| 5 Min | -8 | 8 | 0 | 8 |

| 1 Hour | -20 | 82 | 31 | 51 |

| 6 Hours | +7 | 571 | 289 | 282 |

| 24 Hours | +103 | 2,421 | 1,262 | 1,159 |

Net Buyers = Number of buyers minus sellers. Data summed across all available pairs for this token.

Listed On

Trackers:

DEX Markets:

Trading Pairs for

3hflqhtf5hr5dybxh6bmtratm9qzstveguma8gx6pump

DEX: Raydium

Pair With: buidl/SOL

Liquidity: $452,776

DEX: Meteora

Pair With: buidl/SOL

Liquidity: $9,853

DEX: Meteora

Pair With: buidl/SOL

Liquidity: $8,548

DEX: Meteora

Pair With: buidl/SOL

Liquidity: $1,217

DEX: Meteora

Pair With: buidl/SOL

Liquidity: $988

DEX: Meteora

Pair With: buidl/SOL

Liquidity: $117

DEX: Pumpswap

Pair With: buidl/SOL

Liquidity: $38

DEX: Raydium

Pair With: buidl/SOL

Liquidity: $45

DEX: Raydium

Pair With: buidl/SOL

Liquidity: $70

DEX: Meteora

Pair With: buidl/SOL

Liquidity: $177

DEX: Meteora

Pair With: buidl/MMDD

Liquidity: $N/A

Community Mentions

10,391 followers · Jun 8, 2025, 6:11 PM

Growth over the last month was pretty much only driven by USDT + USDe

Δ over the last month

- USDT: +$5.1bn

- USDC: -$0.3bn

- USDe: +$1.2bn

- DAI+USDS: -$0.2bn

- BUIDL: $0.0bn

cc: @banterlytics

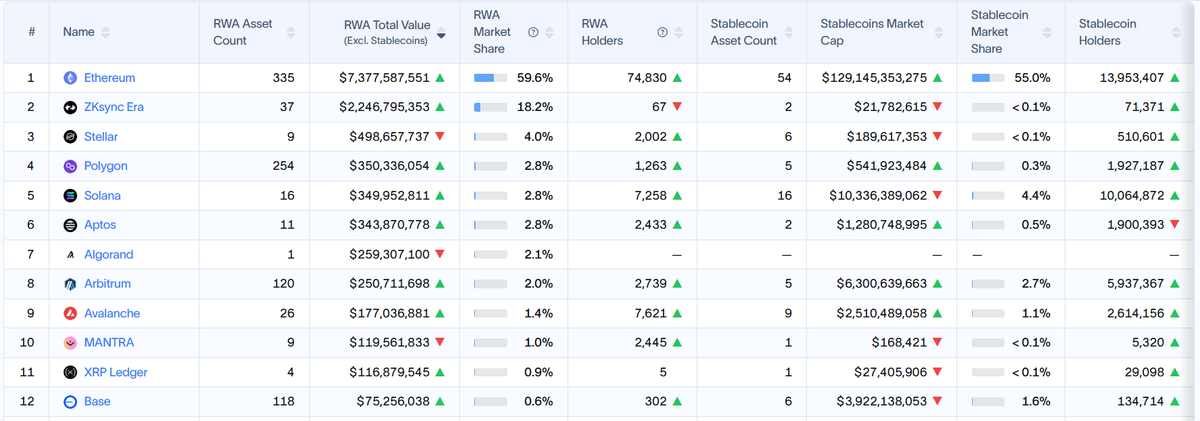

5,189 followers · Jun 7, 2025, 8:28 AM

A 3–5x in RWA TVL could easily reflect in a strong upward revaluation of $APT, especially if utility + staking + fees align.

Let’s watch this closely. 🧐

Aptos has silently climbed to the 6th spot in the RWA rankings with $344M in tokenized assets. They're literally just $6M behind Solana! 👀

Aptos: $343.9M across 11 assets

@solana: $350.0M across 16 assets.

What's fascinating here is the efficiency.

Aptos is achieving nearly identical TVL with 31% fewer assets. This suggests higher average value per tokenized asset on Aptos.

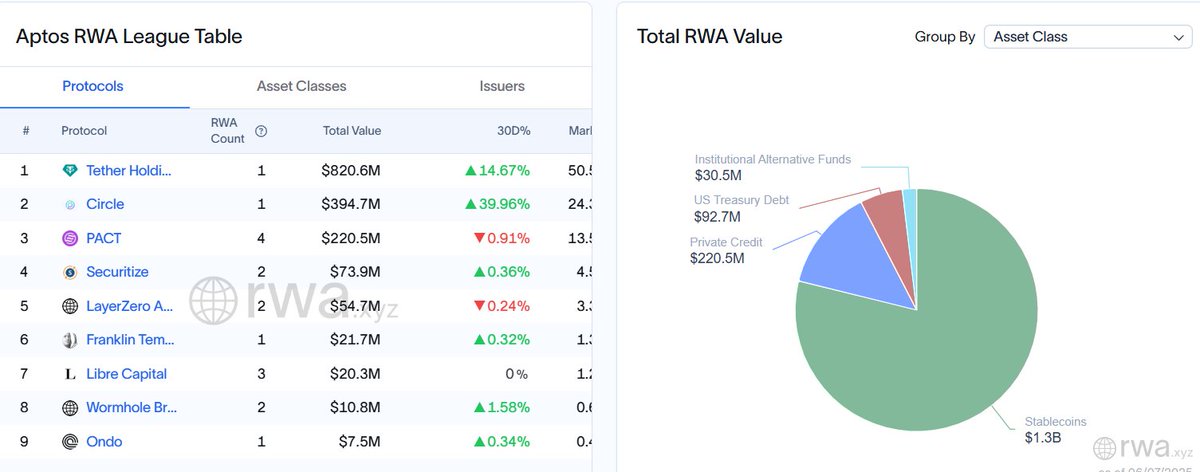

The big players aren't sleeping on Aptos:

• Tether/USDT: $820.6M (50.9% market share)

• Circle/USDC: $394.7M (24.3%)

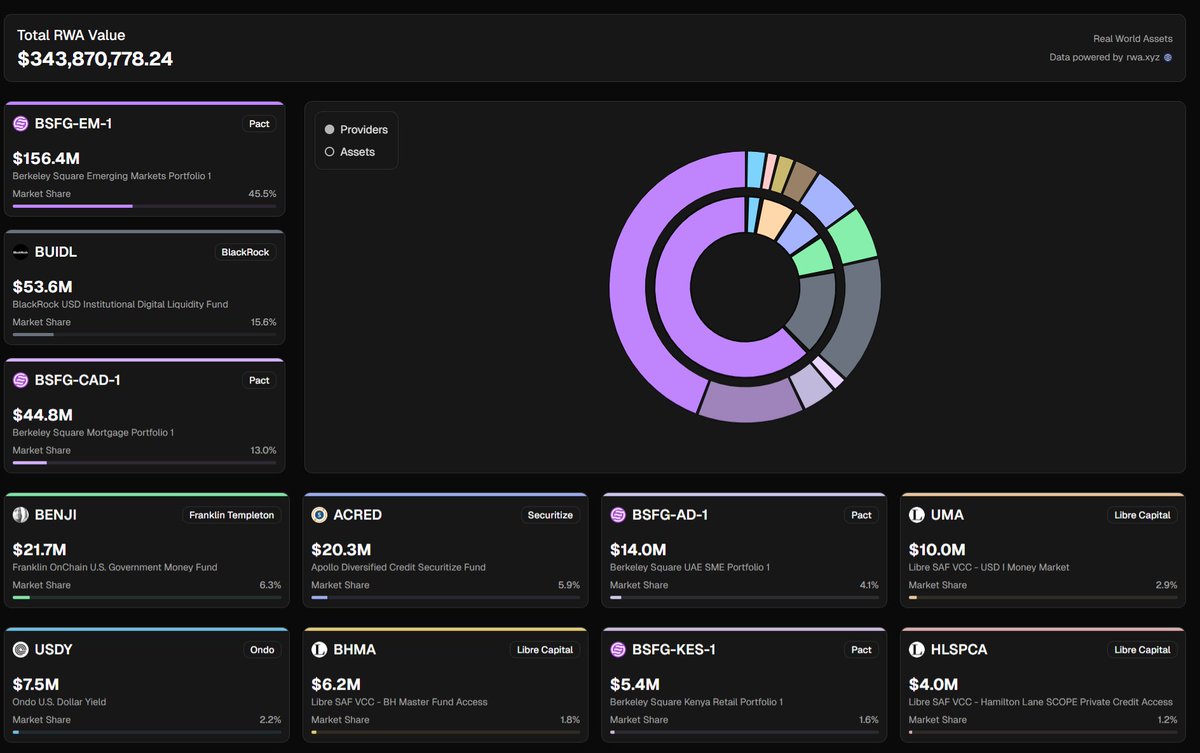

• PACT: $220.5M (13.5%)

• BlackRock's BUIDL: $53.6M (15.6% market share)

BlackRock, the world's largest asset manager - has a presence on Aptos.

This institutional validation cannot be overstated.

Looking at the distribution:

• Stablecoins: $1.3B (the foundation)

• Private Credit: $220.5M

• US Treasury Debt: $92.7M

• Institutional Alternative Funds: $30.5M

This diversity shows Aptos isn't just a one-trick pony. They're building across multiple RWA categories simultaneously.

@pactconsortium bringing Berkeley Square funds ($156.3M + $44.9M) and @BlackRock bringing BUIDL ($53.6M) to Aptos gives it something many L1s lack: institutional credibility.

@FTI_US's presence, though smaller at $21.7M, adds another respected name to the roster.

What happens when RWAs hit mass adoption?

Imagine this:

• Bonds, real estate, invoices, treasuries—tokenized on-chain

• Billions flowing in from TradFi

• Aptos positioned as the high-speed, high-throughput backbone

The value of APT could reflect that future.

Now add some spice.

•Tokenized assets become the base layer for DeFi 2.0

• Lending against RWA collateral

• Yield from real-world cash flows

• Cross-border stablecoin rails built on Aptos

All roads lead to increased demand for APT, both in utility and value.

If RWAs continue their path to becoming a multi-trillion dollar on-chain market as many predict, Aptos is quietly positioning itself to capture significant value.

55,321 followers · Jun 6, 2025, 4:56 PM

"Since its launch, BUIDL has distributed more than $43.4M in dividends, highlighting growing demand for institutional-grade, on-chain yield products."

@BTCTN:

15,173 followers · Jun 6, 2025, 9:37 AM

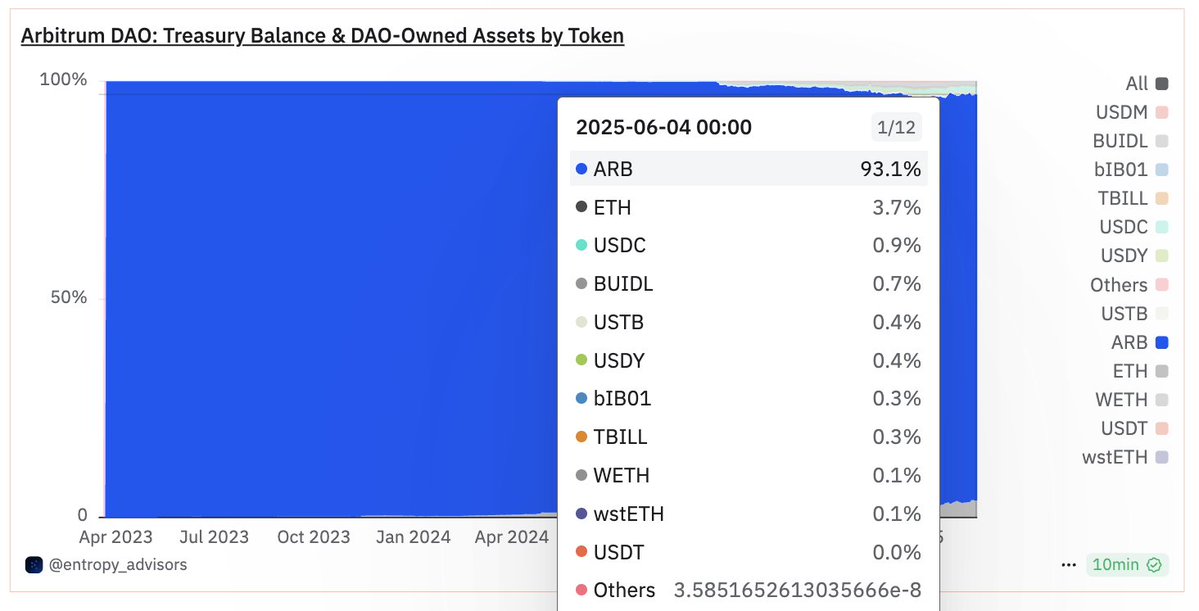

1. STEP: Investing in tokenized US Treasuries like BUIDL

2. Treasury Management: Converting idle ETH into yield-bearing assets

3. Timeboost: Increasing DAO revenue in ETH

0 followers · Jun 4, 2025, 2:28 PM

0 followers · Jun 4, 2025, 2:24 PM

BUIDL由贝莱德与Securitize合作推出,投资标的包括美国国债、现金及回购协议,通过以太坊、Solana等7条区块链发行代币。5月派息中,以太坊网络占比93.7%(约937万美元),其余链合计占比6.3%。该基金仅向合格投资者开放,个人最低投资门槛500万美元,机构2500万美元,资产由BNY Mellon等机构托管。

0 followers · Jun 3, 2025, 11:16 AM

Alpha 今日已上架 no face(noface)、turtle neck(turtle)、Z(Z)、OnePiece(1PIECE)、Zircuit(ZRC)、BDXN(BDXN)和 GRIFT(GRIFT),进入 APP 即可交易。

Gate Alpha 现已支持 SOL、ETH、BNB Chain 及 Base 等热门公链,用户无需手动换链、充值或授权,即可使用现货账户中的 USDT 直购链上热门资产。

15,173 followers · Jun 2, 2025, 1:00 PM

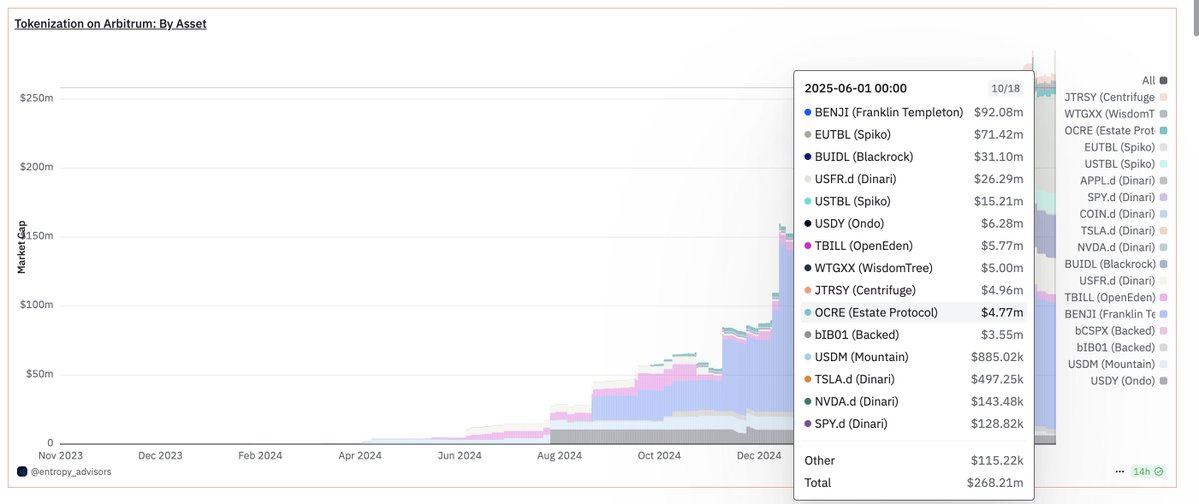

Issuers utilizing Arbitrum include:

- Blackrock in partnership with @Securitize BUIDL

- Franklin Templeton @FTDA_US BENJI

- WisdomTree @WisdomTreePrime WTGXX

- Janus Henderson @JHIAdvisors in collaboration with @centrifuge JTRSY

8,216 followers · May 30, 2025, 11:35 AM

Resilience at the oracle or price feed layer is incredibly important for DeFi protocols

Being able to rely on more proven frameworks, like Redstone, is a big win for Solana DeFi

0 followers · May 30, 2025, 12:30 AM

AAA

0.81507787

2 MOn

ZIPPY

0.00002277

25 Min

Ghibli

0.00264159

3 MOn

KMNO

0.05362494

1.1 yr

AAVE

258.97740394

2.2 yr