Middle Party ($MP)

dp9dknyc9lemmemc3msrjxkr7vgn8ssuxjkhuyjvt84e

$0.004883

0.00003044 SOL

+589.00% (24h)

Market Cap

$4,883,402

Liquidity

$382,604

Holders

1,739(Top 10: 16.41%)

Blockchain

Solana

Contract Address

dp9dknyc9lemmemc3msrjxkr7vgn8ssuxjkhuyjvt84e

AGE

3 hours (Jun 9, 2025)

DEXes

Raydium

About Middle Party

The token name Middle Party derives from its conceptual positioning as a mediator for building consensus equilibrium, suggesting unique scenarios for balancing multiparty interactions. Its core narrative revolves around a demand-supply calibration system powered by token holders' real-time decision-making to reshape value flow patterns within the network.

Middle Party (MP) is a 3 hours old token on the Solana blockchain. Current price: $0.004883 (+589.00% 24h). Market cap: $4,883,402. Liquidity: $382,604. Contract: dp9dknyc9lemmemc3msrjxkr7vgn8ssuxjkhuyjvt84e. Tracked on Dexscreener. Traded on Raydium.

Disclaimer: Information provided is for general purposes only and not financial advice. Meme tokens can be highly volatile. Always do your own research (DYOR).

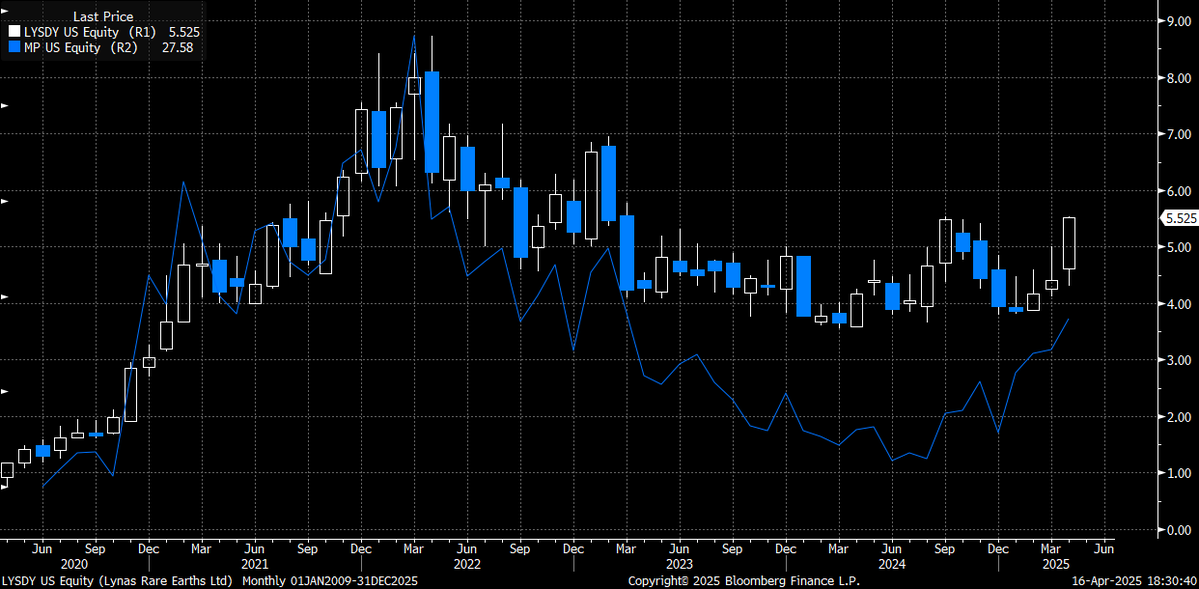

MP/SOL Price Chart

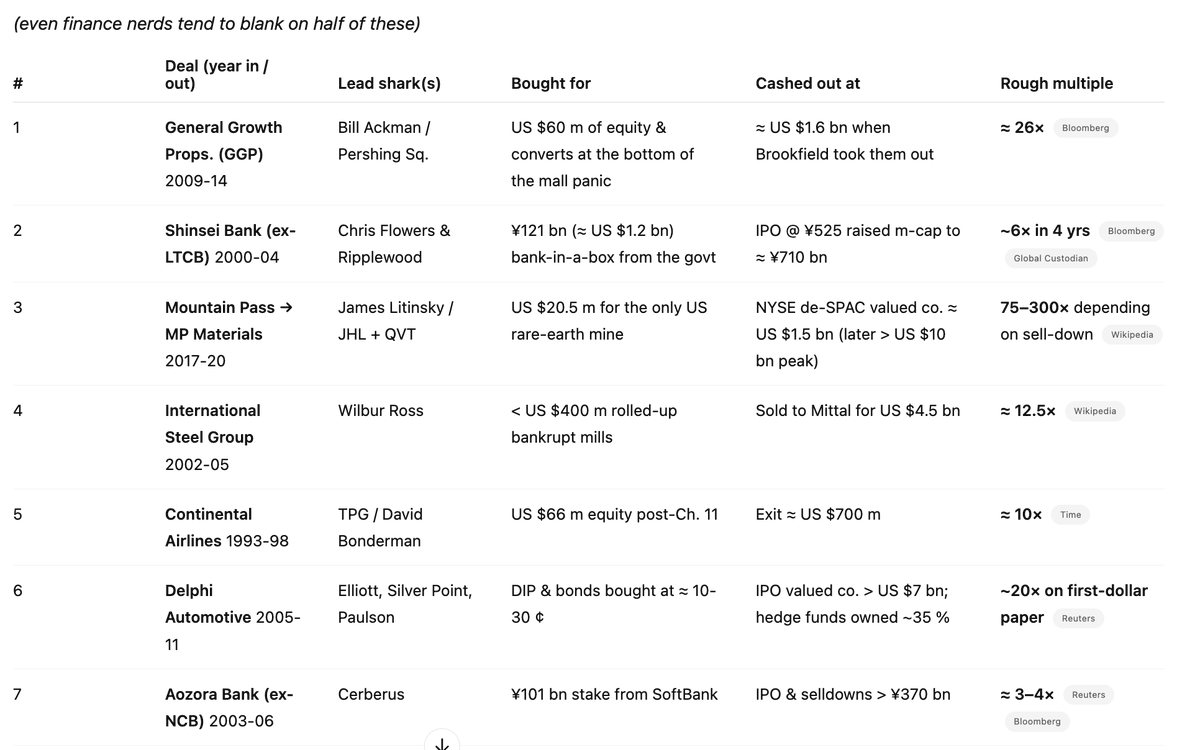

| Timeframe | Price Change | Volume (USD) |

|---|---|---|

| 5 Min | +0.51% | $126,963.65 |

| 1 Hour | +11.29% | $2,145,731.62 |

| 6 Hours | +589.00% | $8,041,449.76 |

| 24 Hours | +589.00% | $8,041,449.76 |

Statistics

Market Cap

$4,883,402

Volume (24h)

$8,041,449.76

Fully Diluted Valuation (FDV)

$4,883,402

Circulating Supply

0

Total Supply

0

Max Supply

0

Holders

1,739+

All Time High (ATH)

N/A

All Time Low (ATL)

N/A

Buyers & Sellers Overview

| Timeframe | Net Buyers | Total Traders | Buyers | Sellers |

|---|---|---|---|---|

| 5 Min | -2 | 58 | 28 | 30 |

| 1 Hour | +183 | 871 | 527 | 344 |

| 6 Hours | +958 | 3,270 | 2,114 | 1,156 |

| 24 Hours | +958 | 3,270 | 2,114 | 1,156 |

Net Buyers = Number of buyers minus sellers. Data summed across all available pairs for this token.

Listed On

Trackers:

DEX Markets:

Trading Pairs for

dp9dknyc9lemmemc3msrjxkr7vgn8ssuxjkhuyjvt84e

DEX: Raydium

Pair With: MP/SOL

Liquidity: $382,604

Community Mentions

22,908 followers · May 17, 2025, 7:16 PM

8,278 followers · May 17, 2025, 2:02 PM

8,278 followers · May 17, 2025, 12:52 PM

120,911 followers · May 8, 2025, 9:20 PM

🔹 Summary:

U.S. rare earths producer MP Materials reported a Q1 net loss of $22.6 million, weighed down by rising production and interest costs, though results met analyst expectations.

The company’s recent decision to stop shipping minerals to China marks a major revenue shift, with financial impact set to appear in Q2 results.

🔹 Key Points:

• Q1 net loss was $22.6 million (14 cents/share) vs. $16.5 million profit a year earlier; adjusted loss matched forecasts at 12 cents/share.

• Production rose 10% to 12,213 metric tons of rare earth concentrate; NdPr output surged fourfold to 563 metric tons.

• Costs increased due to low refinery utilization and higher expenses tied to a 2030 convertible note.

• Realized concentrate prices rose 12%, but NdPr prices fell 16% from last year.

• Halting China shipments in response to Beijing’s tariffs will reshape MP’s revenue landscape in the coming quarters.

@CMEActiveTrader Tickers Of Interest: $GC $CL $ZN

Tickers Of Interest: $MP $USD $DXY $SPX $DJI $IXIC

120,911 followers · May 6, 2025, 3:18 PM

🔹 Summary:

Saudi Arabia and the U.S. are set to negotiate a mining and minerals cooperation agreement, aiming to deepen ties in critical resource sectors as Riyadh accelerates its Vision 2030 diversification strategy.

The talks come ahead of President Trump’s visit and amid Saudi efforts to boost rare earths and global mining partnerships.

🔹 Key Points:

• The memorandum will be negotiated by Saudi Arabia’s Ministry of Industry and the U.S. Department of Energy.

• Saudi Arabia recently raised its minerals reserve estimate to $2.5 trillion, driven by rare earth finds.

• Mining giant Ma'aden is considering a rare earths processing partnership with MP Materials, Lynas, Shenghe, or Neo Performance.

• The Manara Minerals JV recently acquired a 10% stake in Vale’s $26B copper and nickel unit.

• The mining push is central to Saudi Arabia’s bid to reduce reliance on oil revenues.

Tickers Of Interest: $MP $VALE $USD $WTI $GLD

120,911 followers · May 1, 2025, 10:12 AM

🔹 Summary:

The U.S.-developed AI program designed to forecast critical minerals prices and supply has been handed to the nonprofit Critical Minerals Forum (CMF) to boost transparency and facilitate Western supply deals.

Major players like Volkswagen, MP Materials, and RTX are among early users, as the CMF aims to curb China's dominance and foster long-term investment in Western mining projects.

🔹 Key Points:

• The CMF now manages the Pentagon’s AI-driven Open Price Exploration tool, targeting critical minerals pricing and supply chains.

• Members include Volkswagen, South32, MP Materials, and RTX, with the model set to guide investment and secure metals supply.

• The AI uses 70+ data sets, aiming to predict long-term costs by factoring out market manipulation and unexpected shocks.

• Skeptics question the model’s predictive power, but supporters see it as vital to de-risk mining deals and promote U.S.-based projects.

• DARPA funds the project through 2029, with plans to broaden CMF membership globally to enhance market transparency.

@CMEActiveTrader Tickers Of Interest: $HG $AL $NI $ZN

Tickers Of Interest: $MP $RTX $VWAGY $GLD $USD $SPY

120,911 followers · May 1, 2025, 6:54 AM

🔹 Summary:

The U.S. and Ukraine signed a high-profile accord granting Washington preferential access to Ukrainian critical minerals while establishing a joint fund to aid Ukraine’s reconstruction.

The deal, championed by President Trump, focuses on rare earths and other strategic materials vital for energy, defense, and technology sectors.

🔹 Key Points:

• Ukraine holds deposits of 22 EU-listed critical minerals, including rare earths like neodymium, scandium, and significant lithium reserves.

• Ukraine’s lithium reserves are among Europe’s largest, though key deposits in Donetsk and Zaporizhzhia are under Russian occupation.

• The deal ensures Ukraine retains ownership of its subsoil and faces no debt obligations under the agreement.

• The accord includes new U.S. investment pledges and could facilitate air defense assistance, though no direct security guarantees were included.

• Analysts note Ukraine’s mining sector offers major long-term potential but faces regulatory and infrastructure hurdles.

@CMEActiveTrader Tickers Of Interest: $NG $HG $GC $ZR $UX

Tickers Of Interest: $USD $UAH $LIT $MP $ALB $PLL

120,911 followers · May 1, 2025, 5:14 AM

🔹 Summary:

Mining tycoon Gina Rinehart called for Australia to adopt Trump-style policies focused on cutting government costs, boosting fossil fuels, and ramping up defence spending ahead of this weekend’s national election.

Her comments amplify support for opposition leader Peter Dutton’s conservative platform as polls show Labor maintaining its lead amid voter concerns over Trump’s global trade impacts.

🔹 Key Points:

• Rinehart, Australia’s richest person, criticized bureaucratic “largesse” and backed slashing 41,000 government jobs.

• She advocates withdrawing from the Paris Agreement and prioritizing fossil fuel expansion, aligning with Dutton’s pro-gas and nuclear push.

• Rinehart called for 5% of GDP to be allocated to national defence, far exceeding current government commitments.

• Her Hancock Prospecting tripled political donations in 2024 and revealed a $1.3B U.S. investment portfolio focused on energy and rare earths.

• Despite support for Dutton, Labor has gained in polls, echoing anti-Trump backlash seen in Canada’s recent election.

@CMEActiveTrader Tickers Of Interest: $NG $CL $HG $ZR $UX

Tickers Of Interest: $AUD $USD $RIO $BHP $FMG $MP

120,911 followers · Apr 21, 2025, 10:38 AM

🔹 Summary:

Republican lawmakers pushing to extend Trump-era tax cuts face growing tension as clean energy investments surge in their districts—benefiting from Biden-era policies they now may have to repeal.

With $125 billion in green energy projects in GOP areas, efforts to slash related tax credits to fund $4.5 trillion in tax cuts risk undermining local economic wins and job creation.

🔹 Key Points:

• 11 of 26 Republican tax writers in Congress represent districts with billions in clean energy investments from companies like Ford, GM, and Honda.

• Biden’s Inflation Reduction Act sparked $165B+ in clean energy manufacturing projects, 75% of which landed in Republican-held districts.

• Trump opposes green energy subsidies, but many GOP districts now rely on them for job creation and growth.

• Automakers and energy firms are privately lobbying lawmakers to preserve tax credits tied to EVs, batteries, and rare earth production.

• A repeal of these credits risks alienating GOP constituencies and reversing manufacturing progress in red states.

@CMEActiveTrader Tickers Of Interest: $RB $CL $NG

Tickers Of Interest: $F $GM $HMC $TSLA $MP $XLE $USD $TNX $XLI $EVGO $CHPT

47,115 followers · Apr 17, 2025, 1:31 AM

CHLOE

0.00604014

2 H

oUSDT

1.00087290

3 MOn

OGGIE

0.00004087

39 Min

BOME

0.00198855

1.2 yr

WBTC

109,701.92607911

3 MOn