$0.000011

0.00000007649 SOL

-82.03% (24h)

Market Cap

$11,206

Liquidity

$11,138

Holders

209(Top 10: 63.86%)

Blockchain

Solana

Contract Address

dras4fniswvmcajedflfxecspv61ie42hqri5rgxpump

AGE

18 hours (Jun 13, 2025)

DEXes

Pumpswap, Meteora, Pumpfun

About Libertarian Porcupine

The token name originates from the Libertarian Party's mascot 'Porcupine', extending libertarian ideology through blockchain. It emphasizes propagating core libertarian principles in crypto culture - individual sovereignty, non-coercive cooperation and anti-regulation philosophy, positioning as an on-chain implementation vehicle for this political doctrine.

Libertarian Porcupine (LP) is a 18 hours old token on the Solana blockchain. Current price: $0.000011 (-82.03% 24h). Market cap: $11,206. Liquidity: $11,138. Contract: dras4fniswvmcajedflfxecspv61ie42hqri5rgxpump. Tracked on Dexscreener. Traded on Pumpswap, Meteora, Pumpfun.

Key Factors & Recent Activity 2025-06-13T08:54:07

- Hey, here's what I've been looking at for this LP token on Solana:

- Token pair just launched; created very recently.

- One-hour surge of almost 60% then steep drop later.

- Low liquidity—only about fifteen grand in play.

- Price swings so big, red flags are waving.

- This feels like a rapid pump or risky experiment. For a 10-year-old: Imagine a brand-new trading toy that suddenly gets really popular, but then its value quickly falls. It’s exciting but also super risky.

Disclaimer: Information provided is for general purposes only and not financial advice. Meme tokens can be highly volatile. Always do your own research (DYOR).

Visit Official Website →LP/SOL Price Chart

| Timeframe | Price Change | Volume (USD) |

|---|---|---|

| 5 Min | -13.34% | $414.85 |

| 1 Hour | -25.51% | $897.01 |

| 6 Hours | -21.28% | $5,506.63 |

| 24 Hours | -82.03% | $323,285.47 |

Statistics

Market Cap

$11,206

Volume (24h)

$424,808.39

Fully Diluted Valuation (FDV)

$11,206

Circulating Supply

0

Total Supply

0

Max Supply

0

Holders

209+

All Time High (ATH)

N/A

All Time Low (ATL)

N/A

Buyers & Sellers Overview

| Timeframe | Net Buyers | Total Traders | Buyers | Sellers |

|---|---|---|---|---|

| 5 Min | -1 | 5 | 2 | 3 |

| 1 Hour | -8 | 16 | 4 | 12 |

| 6 Hours | -9 | 79 | 35 | 44 |

| 24 Hours | +352 | 6,406 | 3,379 | 3,027 |

Net Buyers = Number of buyers minus sellers. Data summed across all available pairs for this token.

Listed On

Trackers:

DEX Markets:

Trading Pairs for

dras4fniswvmcajedflfxecspv61ie42hqri5rgxpump

DEX: Pumpswap

Pair With: LP/SOL

Liquidity: $11,138

DEX: Meteora

Pair With: LP/SOL

Liquidity: $10

DEX: Pumpfun

Pair With: LP/SOL

Liquidity: $N/A

Community Mentions

90,345 followers · Jun 13, 2025, 2:58 AM

最近 @TorchTon 和 @FivaProtocol 联动,正式把 $tgUSD 纳入了 #FIVA协议 的收益拆分体系,给整个 TON 生态又开辟了一个新的“结构化收益入口”。

这背后其实非常值得专门拆解一下:

一、tgUSD 到底是啥?

(1)tgUSD 是 Telegram 官方生态内的稳定币,由 The Open Network (TON) 直接发行;

(2)目标是成为 TON 生态系统内部的结算和支付媒介,长期定位有点类似 Telegram 版的 USDC;

(3)目前市值已经突破 1 亿美金,并且在 Telegram 钱包、P2P、支付、DeFi 中逐步扩张。

一句话理解: $tgUSD 已经是 TON 生态的“稳定币底层锚定资产”。

二、这次 FIVA + Torch 联动做了什么?

(1)将 tgUSD 引入 FIVA 协议的 PT / YT / LP 三种收益结构;

(2)直接通过 Torch UI 支持一键进入拆分、做市、收益挖矿;

(3)叠加了 20 倍的积分 XP boost,进入了 TeFi Alliance 空投激励计划;

(4)当前部分池子显示 APY 年化收益高达 2000%+(主要来自积分激励期叠加)

✅ 简单理解就是:原本只能简单持有 tgUSD,现在可以通过 FIVA 把它玩成结构化收益型稳定币产品了。

三、tgUSD 模式下的 PT / YT / LP 有什么特点?

PT-tgUSD

(1)仅代表本金,到期按 1:1 取回;

(2)适合想锁住本金、不参与收益博弈的保守型用户。

YT-tgUSD

(1)代表全部未来收益;

(2)收益水平取决于底层收益模型,收益高低完全归 YT 所有;

(3)高风险高回报,适合进取型用户。

LP-tgUSD

(1)同时提供 PT 与 YT 做市,赚取手续费和积分奖励;

(2)到期免除无常损失,是目前相对平衡安全的参与方式。

四、这轮合作背后,其实标志着什么?

(1)FIVA 开始把更多 TON 生态资产纳入自己的收益协议矩阵

(2)tgUSD 的引入,会让整个稳定币赛道的“收益率管理”变得标准化;

(3)未来无论 TON 生态如何扩张,FIVA 都可能成为稳定收益的清算层和收益锚定层;

(4)积分机制(XP boost)+ 空投刺激,短期内也让用户参与度提升了一个新高度。

FIVA 正在慢慢把「结构化收益协议」这套复杂但非常有前景的模型,逐渐往 TON 各个板块渗透。

$tgUSD 只是第一步,后续当 RWA、借贷、做市、稳定币等模块全面连接后,FIVA 的玩法会变得更立体。

现在其实正是布局这类协议的红利前置期。

@FivaProtocol @TorchTon @ton_blockchain #FIVA #FivaProtocol

~~~🔸立即体验🔸~~~

如果你已经迫不及待想要体验 #Fiva ,你可以:

(1)TG版:

(2)Web版:

70,799 followers · Jun 11, 2025, 9:34 AM

- Pendle crossed $1.42B in weekly trading volume

- New pools:

- Aave sGHO 28-AUG [ETH]

- Yearn aGHO 25-SEP [ETH]

- Alphagrowth rETH 18-DEC [BASE]

TASTY on Pendle:

- Stables: sUSDf [25-SEP] [ETH] up to 18.48% LP-APY | cUSDO [19-JUN] [ETH] @ 14.93% PT-APY

- ETH: uniETH [26-JUN] [ETH] @ 10.32% LP-APY | weETHs 26-JUN [ETH] @ 5.15% PT-APY

- Trending Markets: USD(Midas) [31-JUL] [ETH] 11.55% PT-APY | aUSDC [14-AUG] [SONIC] 6.97% PT-APY

Last week:

- vePENDLE airdrops continues

- New naming convention for PT/YT

- Crossed $1.5B PT TVL on Aave

- Pendle Print #69:

So yeh, you could say we feelin gud vibes in pendle world fr fr no cap

4,147 followers · Jun 6, 2025, 5:20 AM

$PENDLE

5,826 followers · Jun 5, 2025, 6:25 PM

"But if there’s one constant in Pendle’s evolution, it’s our ability to constantly adapt to find PMF"

Great job team 👏

2,970 followers · Jun 5, 2025, 1:07 PM

> A Pendle pool is essential for bootstrapping a new stablecoin's growth (see USDS)

> Stablecoin PT's are powerful collateral for borrowing (see demand on Aave)

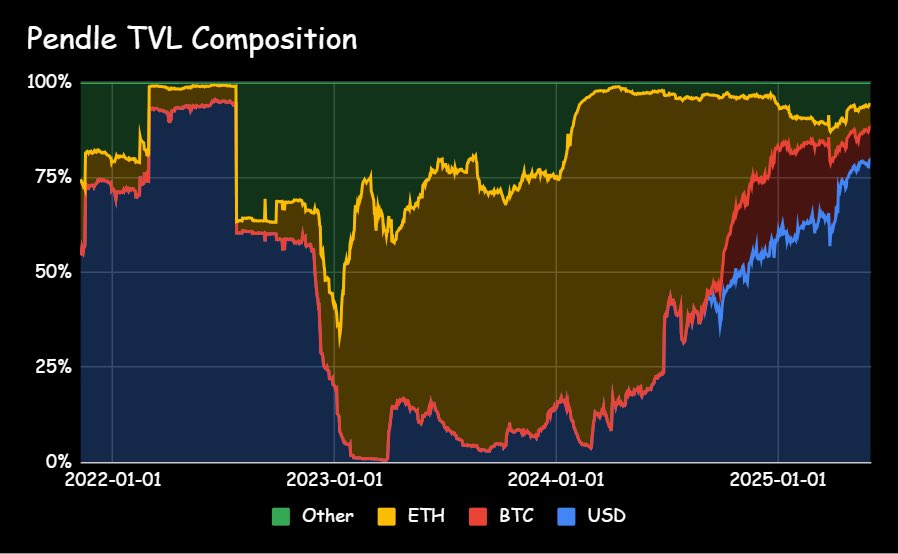

> 83% of TVL is stables (and climbing)

> Captures sector growth - not a bet on one stablecoin project

1,525 followers · Jun 5, 2025, 11:34 AM

It adapts to any DeFi product gaining traction 👇

5,887 followers · Jun 5, 2025, 9:38 AM

pendle 👏

12,733 followers · Jun 5, 2025, 8:34 AM

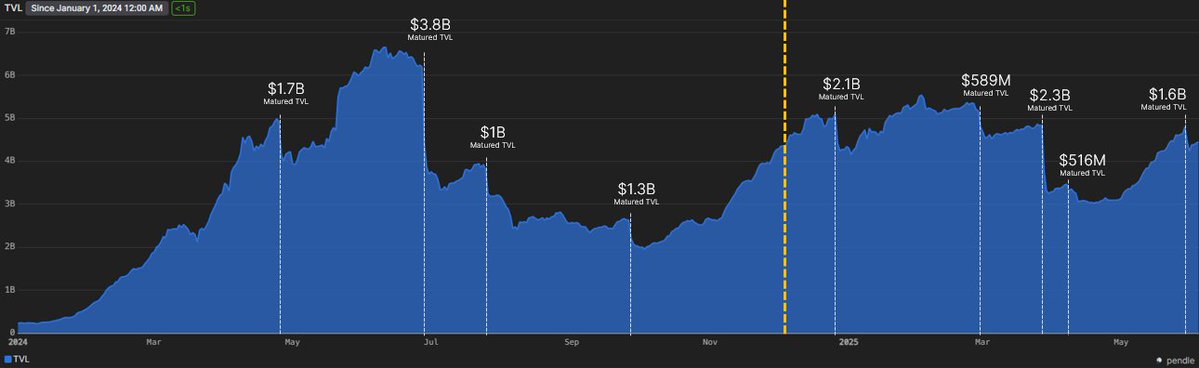

The majority of this was driven by the May 29th maturity event, where $1.6b in TVL reached maturity. In fact, this maturity event had the best liquidity retention rate of all time. The rest came from users buying PTs and looping collateral across money markets, a testament to the utility and composability of Pendle assets.

Historically, Pendle's maturity events have prompted understandable concerns around TVL retention. Since the launch of Pendle V2, we’ve gone through 27 maturity events, 7 of which involved over $1 billion in maturing TVL. Over the course of the last cycles, what has remained consistently true is this:

a) Pendle works. All of our mechanisms have operated as intended over the years. We’ve successfully processed all PT/LP redemptions,including last year’s $3.8 billion June 2024 event

b) Yes, we’ve seen liquidity outflows post-maturity. Some due to macro headwinds, others tied to shifting narratives. But if there’s one constant in Pendle’s evolution, it’s our ability to constantly adapt to find PMF. From LSTs → LRTs → BTCfi → Stablecoins, the nature of Pendle has allowed us to continuously realign to meet the market where it is.

Looking at the recent maturity events in the past 6 months, I believe that Pendle has reached a new stage of growth, with a reasonable offering as the premier yield marketplace.

The Pencosystem is growing, with PTs being increasingly adopted as a trusted collateral across DeFi money markets, including household names such as Aave, Morpho and Euler. The same foundation and growth path are currently being laid for Pendle LPs as well.

Unlike earlier cycles, TVL retention has become significantly more consistent, even as the scale and frequency of maturity events have grown.

Let’s look at some of the numbers from the recent May 29th maturity:

- $4.79B → $4.23B peak-to-trough dropoff (-11.7%) in TVL

- Within one week, TVL rebounded to $4.45B (just -7% from peak)

- 35% of matured TVL migrated to other Pendle pools within a week, the best 7D retention rate of all time

- $1.15B of PT and $236M of LP redemption processed successfully within a week

- Ethena-linked TVL only saw a -6% dip ($2.8B → $2.6B) after 4 days, and has already rebounded back to $2.73B (h/t @jamesjho_)

Today, over 83% of our TVL is in stablecoins, showing a significant shift from our early days dominated by LST and LRT yield farming. Comparatively, stablecoin yields remain evergreen with their demand persisting through bull and bear markets as a reliable tool for wealth preservation.

Unlike our early LRT days where headline-grabbing yields of 80–120% Fixed APY were the norm, the current range of 3–12% Fixed APY reflects a maturing market - and that’s a good thing.

We’re now seeing more stable, reliable yield flows, underpinned by real demand rather than short-lived, mercenary capital.

This coupled with the shift towards more sustainable liquidity dominated by stablecoins, is ideal for Pendle’s long-term trajectory - all while maintaining the flexibility in pivoting to various narratives on demand. This price discovery of yields is crucial in helping the whole financial ecosystem of the crypto space mature as Pendle transitions into a platform offering DeFi yields to TradFi and institutional investors.

The global fixed income market is one of the largest securities markets in the world, valued at US$140 trillion as of 2023 (Securities Industry and Financial Markets Association). The demand for Fixed Yield products is obvious and continuing to grow, and we believe that stablecoin-denominated PTs are DeFi’s best shot at breaking out into the mainstream.

Job’s not done.

149,767 followers · May 29, 2025, 1:00 AM

Plus some special Bills Campaign multipliers (the highest to-date 👀) for a limited time:

🔹20x Bills for YT

🔹12x Bills for every $1 of LP

MERL

0.09680202

3 MOn

AIXBT

0.16896313

7 MOn

schizo

0.00133692

11 MOn

ai16z

0.17307840

8 MOn

SPX

1.51427366

1.5 yr