Pump ($PUMP)

GM5kSXKs73fEU9b92nm49cGwDG5CB4d5t5Mcbm62ecLp

$0.000001

0.000000004426 SOL

-99.74% (24h)

Market Cap

$711

Liquidity

$5

Holders

8(Top 10: 99.98%)

Blockchain

Solana

Contract Address

GM5kSXKs73fEU9b92nm49cGwDG5CB4d5t5Mcbm62ecLp

AGE

7 hours (Jul 15, 2025)

DEXes

Raydium

About Pump

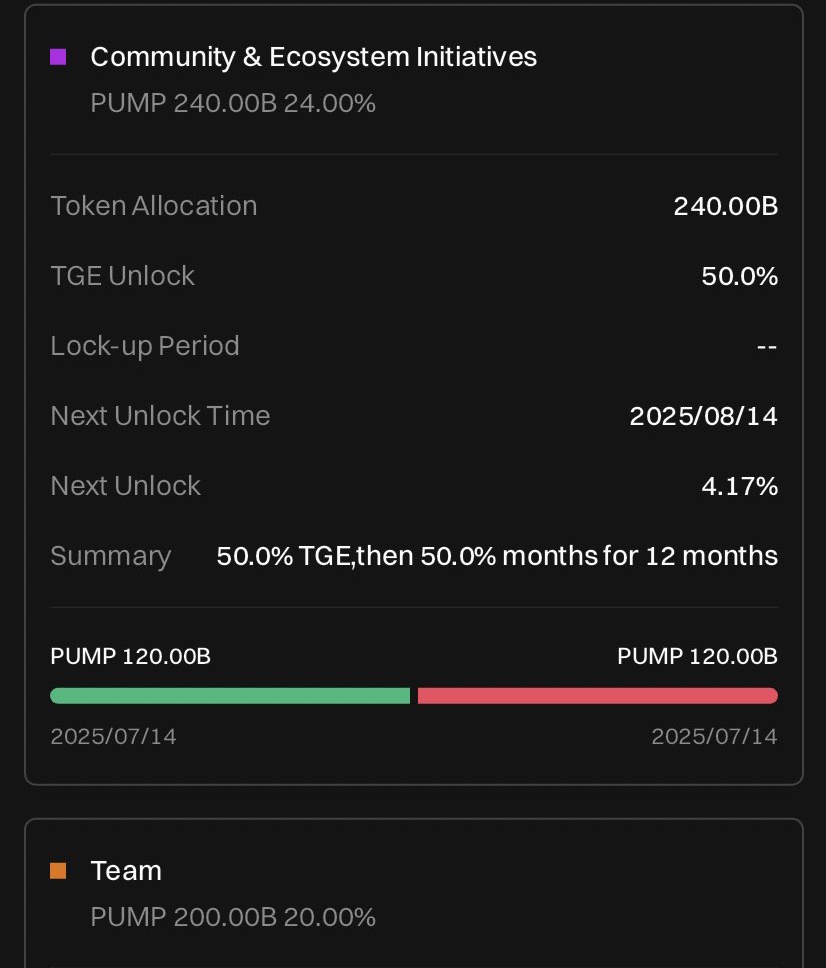

The PUMP token originates from the one-click token launch platform pump.fun, which enables users to create and trade tokens instantly at zero cost, with deep integrations across major exchanges like Coinbase and Hyperliquid. Its narrative centers on being the platform's premier issued token, natively embedded in multi-dex trading scenarios and serving as a critical liquidity hub across interoperable platforms.

Pump (PUMP) GM5kSXKs73fEU9b92nm49cGwDG5CB4d5t5Mcbm62ecLp is a 7 hours old token on the Solana blockchain. Current price: $0.000001 (-99.74% 24h). Market cap: $711. Liquidity: $5. Contract: GM5kSXKs73fEU9b92nm49cGwDG5CB4d5t5Mcbm62ecLp. Tracked on Dexscreener. Traded on Raydium.

Key Factors & Recent Activity 2025-07-15T08:54:06

- Critical news: Developers flagged this token as “shitcoin”.

- Run away events around launch raise major red flags.

- Liquidity is super low – only about five dollars.

- Price crash nearly 100% in a short time—watch out!

- Huge trading volume feels suspicious compared to tiny liquidity.

Disclaimer: Information provided is for general purposes only and not financial advice. Meme tokens can be highly volatile. Always do your own research (DYOR).

PUMP/SOL Price Chart

| Timeframe | Price Change | Volume (USD) |

|---|---|---|

| 5 Min | +0.00% | $0.00 |

| 1 Hour | +0.00% | $0.00 |

| 6 Hours | +0.00% | $0.00 |

| 24 Hours | -99.74% | $664,007.07 |

Statistics

Market Cap

$711

Volume (24h)

$664,007.07

Fully Diluted Valuation (FDV)

$711

Circulating Supply

0

Total Supply

0

Max Supply

0

Holders

8+

All Time High (ATH)

N/A

All Time Low (ATL)

N/A

Buyers & Sellers Overview

| Timeframe | Net Buyers | Total Traders | Buyers | Sellers |

|---|---|---|---|---|

| 5 Min | +0 | 0 | 0 | 0 |

| 1 Hour | +0 | 0 | 0 | 0 |

| 6 Hours | +0 | 0 | 0 | 0 |

| 24 Hours | -226 | 13,430 | 6,602 | 6,828 |

Net Buyers = Number of buyers minus sellers. Data summed across all available pairs for this token.

Listed On

Trackers:

DEX Markets:

Trading Pairs for

GM5kSXKs73fEU9b92nm49cGwDG5CB4d5t5Mcbm62ecLp

DEX: Raydium

Pair With: PUMP/SOL

Liquidity: $5

Community Mentions For #PUMP

3,111 followers · Jul 15, 2025, 8:50 AM

5,021 followers · Jul 15, 2025, 8:42 AM

目前除了大饼和meme之外,在炒作的大叙事只有ETH微策略, $SBET 等公司只要还有溢价,就能够不断融资 + 增发来实现【增加以太坊储备 → 以太坊需求增大,价格升高 → 股价升高 → 继续买以太坊】的飞轮。

大多数山寨只能自救。 $HYPE 这些本身有护城河的代币可以同样玩ETF + 微策略叙事,而没有真实营收的代币只能不断蹭热点寄希望于投机资金来提供退出流动性。

去伪存真算是这一轮周期为数不多的正向趋势。

125,869 followers · Jul 15, 2025, 8:30 AM

Some of the smartest people I know are all-in, calling it the next big thing.

Others swear it’s total trash.

Feels like the real games haven’t even started yet.

10,787 followers · Jul 15, 2025, 8:29 AM

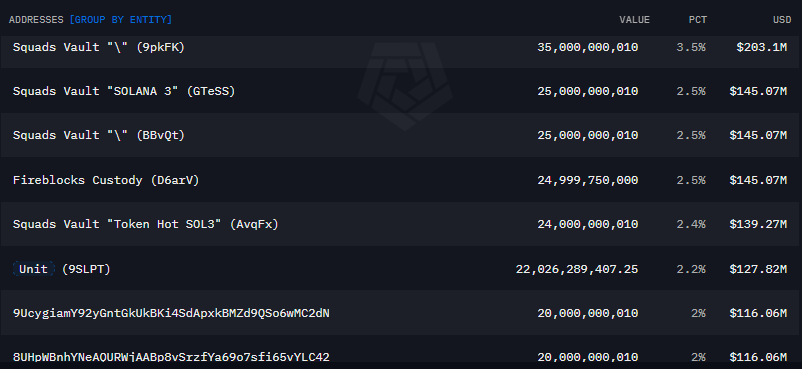

Total TVL is second only to Fireblocks, excluding all pumpfun wallets, with 22B $PUMP representing 2.2% of total supply.

12,194 followers · Jul 15, 2025, 8:27 AM

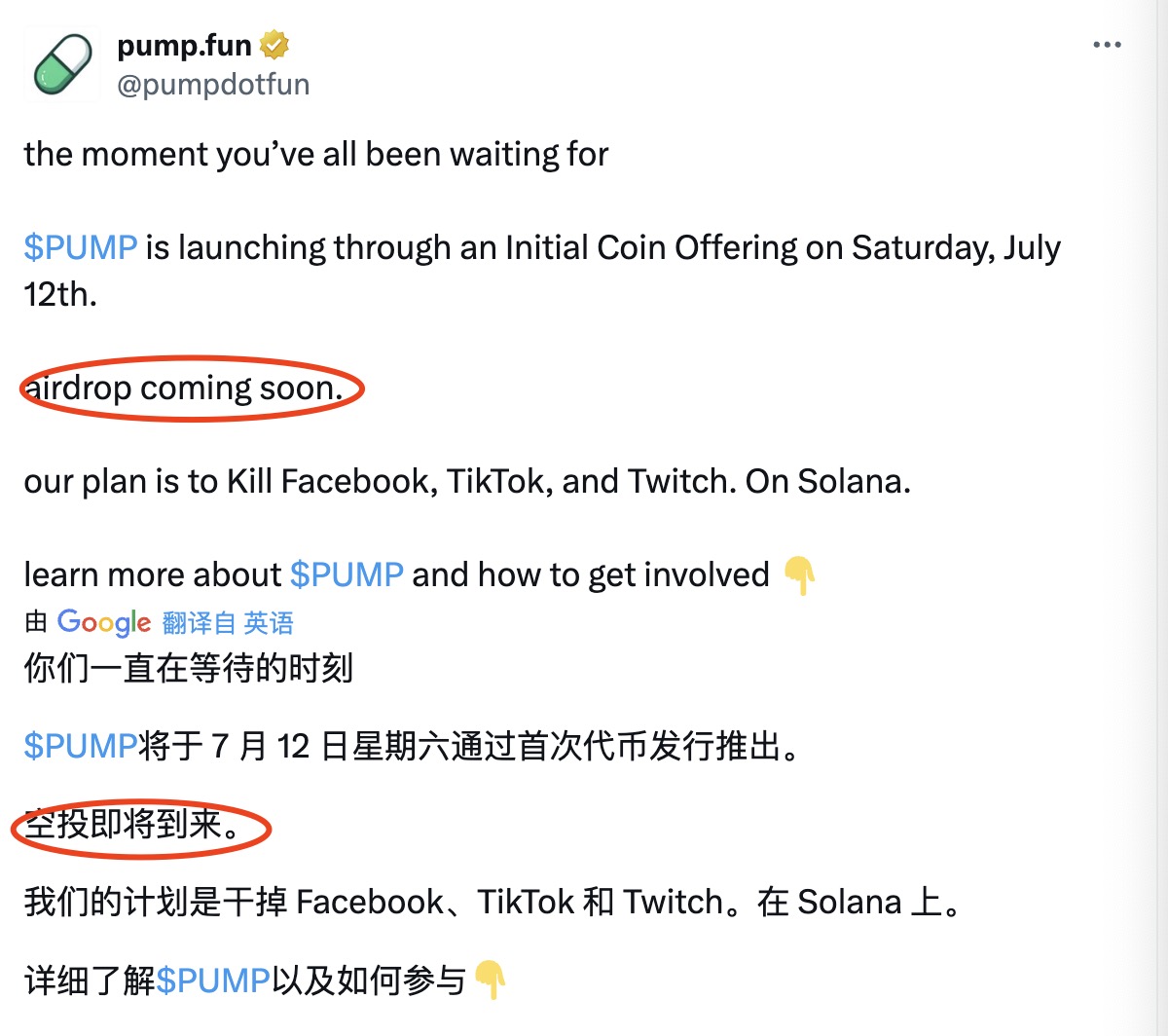

Where is the airdrop? when?

22,369 followers · Jul 15, 2025, 8:19 AM

774,908 followers · Jul 15, 2025, 8:12 AM

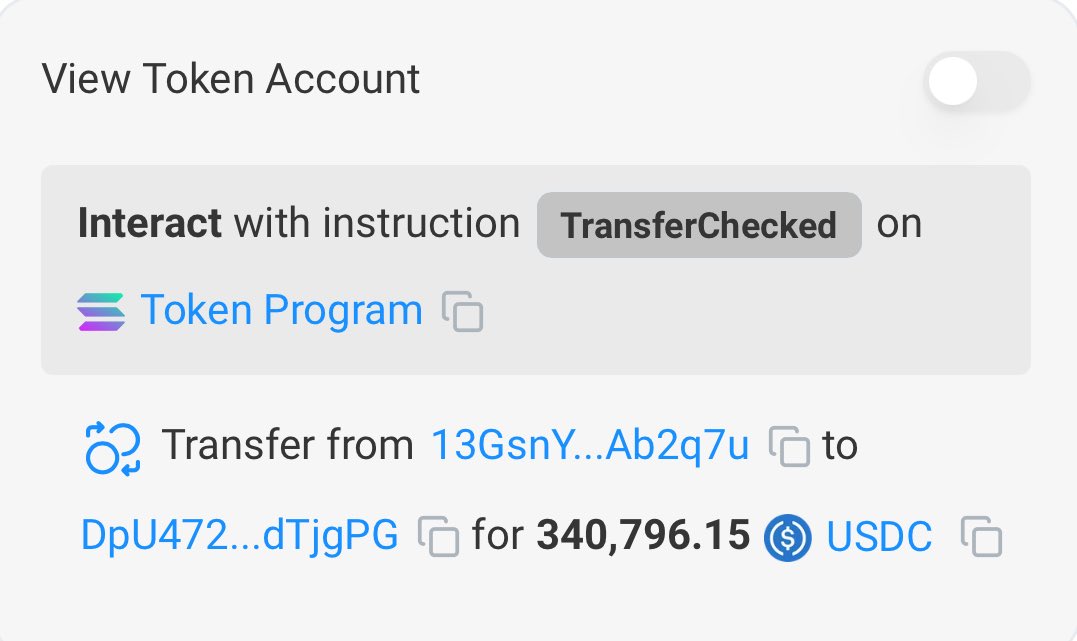

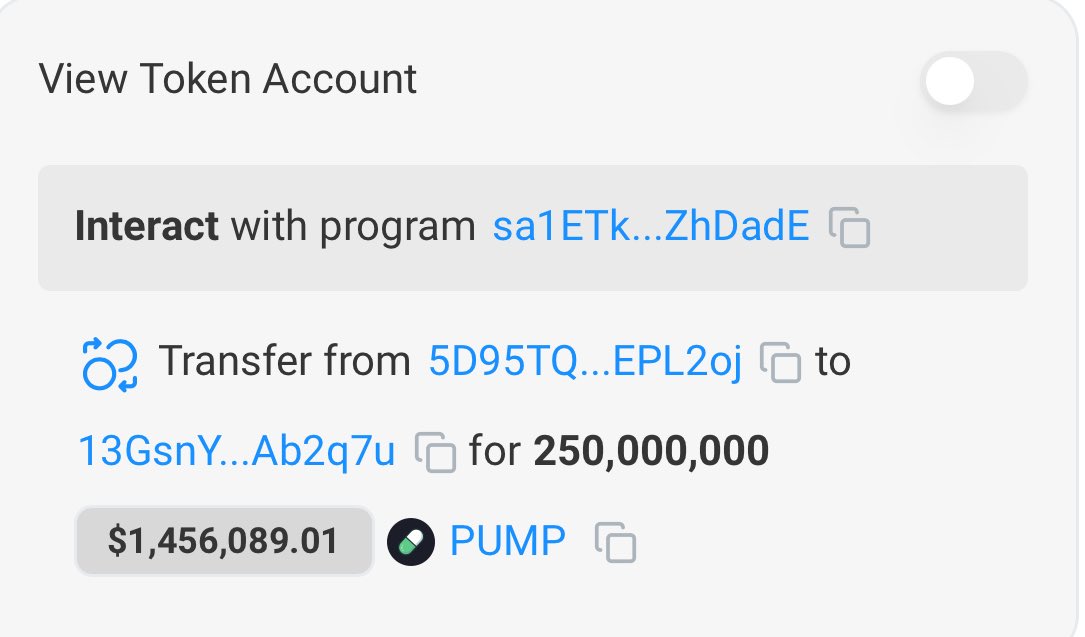

The wallet listed above:

DpU472kGa8KBk9yte5uJbXXy9Scns44qmN5RzTdTjgPG

Received $340,796 USDC from another wallet:

13GsnYqJcx95Yf7gZdXpyUKUkjjYfGmgrDdta4Ab2q7u

This second wallet received PUMP tokens worth $1.8 MILLION just 3 days ago (currently worth around $1.4 million) from address:

He also sent 179 million PUMP tokens ($1M) to this wallet:

6Q6Y3WXCV5wfpowjJ3zV6RA49ZYc7txEwWdTAews9iq4

But that’s NOT ALL, this same wallet also received 100 million PUMP tokens ($550k) from another wallet:

7EamdthyT1hw4i9MdFRyNSUF6LqbJLWSm3rzF1nfv2ZG

Could this all be connected? $1.8 million worth of PUMP. It must be an insider, or maybe even the PUMP founder himself.

20,676 followers · Jul 15, 2025, 8:01 AM

準備把手上閒置的 BTC 丟到各個 BTCFi 裏面, 這樣才拿得住...

上次分享完 BTCFi 在 Aptos 上的 farming 機會, 這次來分享 Sui 的機會✨ 滿期待各鏈因為 BTCFi 的普及再讓場內資金變多, 收益機會的玩法也能夠更多元

很明顯 $PUMP 這次事件讓大家認知到一件事 , 場內不是沒錢, 而是你的 token 不夠吸引人😂 至今仍然有將近 6B 是怎麼回事...

先前應該不少人知道第一波進入 Sui 生態的 BTCFi 協議是 Lombard @Lombard_finance , 現在輪到了 OG 團隊 tBTC @TheTNetwork

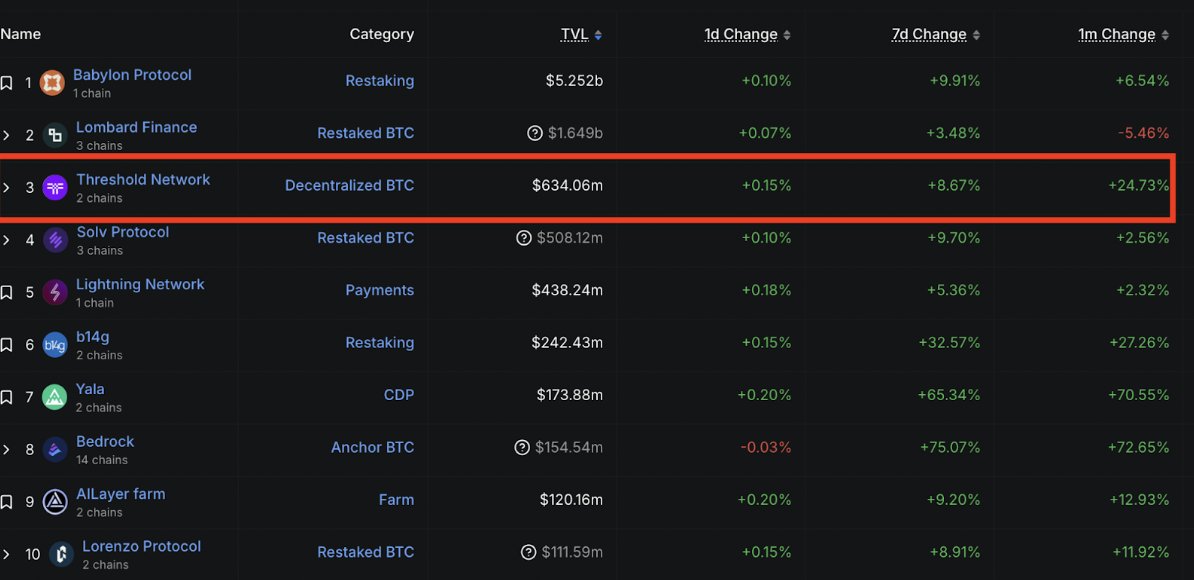

當前 BTC 協議大約有 7B 的 TVL

Threshold Network @TheTNetwork (也就是 tBTC 的發行商)當前為第三名, 過去一個月增長為 25%

如果是以去中心化 BTC 來做分類的話,tBTC 則是當前的第一名

(一些子協議被排除在鏈的 TVL 之外)

----

也可以看到當前八到十名的公鏈之爭挺激烈的

Rank 8:Sui , 當前 TVL 為 2.2B

Rank 9 :Hyperliquid , 當前 TVL 為 1.97B

rank 10:Avalanche , 當前 TVL 為 1.6B

有別於過去 DeFi 生態只有 Lending 以及 CDP 這兩招, 很顯然透過跟更多 BTCFi 協議的合作能夠有效將整體生態 TVL 做一個推升, 由於 tbtc 主打原生的 BTC 資產, 因此能夠打開未來更多合作的可能性

大部分人其實都只知道 wbtc (孫哥、bitgo)或是先前很紅的 LBTC, 但其實最去中心化的 tbtc 也算是非常 OG 代表了, 團隊已經開發近五年時間

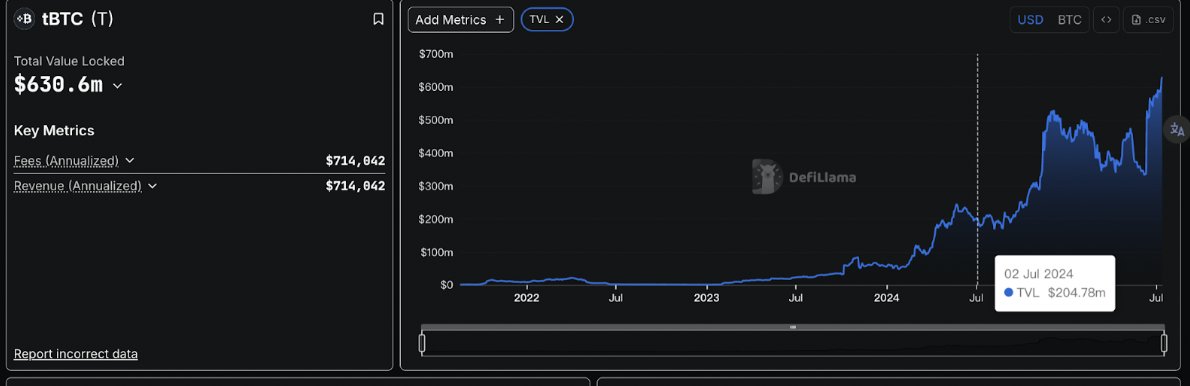

tbtc 的 TVL 也在這一年之間成長了 350% , 當前的體量為 630M

其實早在去年 4 月我們 @cryptowesearch 寫過的 Mezo @MezoNetwork 也是同一間公司做的 DeFi 鏈 , 我也整理了 @0xCheeezzyyyy 幾個關於 BTCFi 的 insight

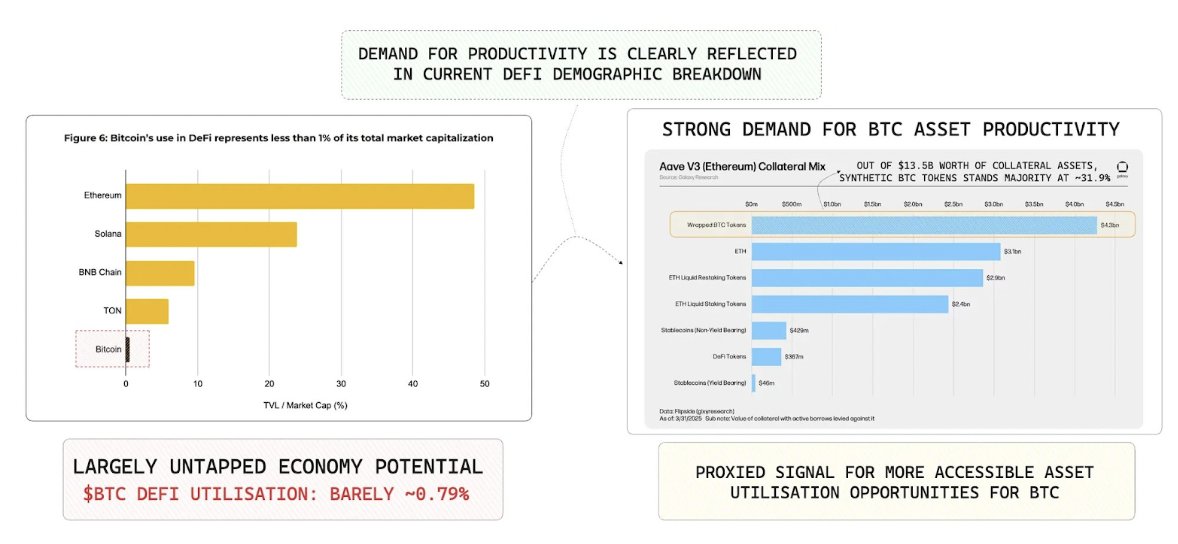

1️⃣ 當前 Aave 上的 TVL 有將近 32% 都來自 BTC

2️⃣ BTCFi 的成長空間極高,2024 年即使有一波爆發, 作為賺取收益的 BTC 依然不到 1% (0.79%)

3️⃣ 當前市場需要更多能夠使用原生 BTC 來賺取收益的場景

而這就是 tBTC 想要努力的方向

圖為去年年底的數據, 以 tbtc 的特點來說就是去中心化的資產託管,隨著 BTC 持續上漲所帶來的空間, 不難想像當中肯定會像當前的穩定幣賽道一般多出更多競爭者, 就看我們如何從中找機會了

💡tBTC 是 Threshold Network 推出的 ,隨著在上個月 6 號時上線了 Starknet,當前已經支援了多達八條鏈, Starknet 接入的 DeFi 包含 @EkuboProtocol 以及 @vesuxyz , 分別是 DEX 和借貸的代表

這次在 Sui 上面合作的協議包含 @bluefinapp 以及 @AlphaLendSui

Bluefin 上面提供 TBTC-LBTC 流動性區間有機會達到超過 1000% 以上的 APR, 這是跟隨交易量變化的, 交易量激增的話 APR 也會高起來, 平常利率大約在 25-30% 左右震盪

AlphaLend 上面的 supply APR 則是有 9.2% (tbtc + stSUI),Borrow 則是 7.6% , 初期我看有超過 20% APR , 挺香的, 現在降了一點

💡和 EVM 生態的 @asymmetryfin 合作,支持 tbtc 作為抵押品借出穩定幣 USDaf , 有著超過 16% 的收益率

儘管技術複雜度較高且使用率仍低於 WBTC , 但隨著與更多生態以及 DeFi 的合作,相信 tbtc 可以慢慢站穩腳步把 TVL 累積回來

125,869 followers · Jul 15, 2025, 8:00 AM

USDUC

0.01506714

2 MOn

MN

0.00004900

21.5 Days

AGENT

0.20374904

8 MOn

VGL

0.00226756

21.8 Days

BULLA

0.05344187

1 MOn