JITO ($JTO)

jtojtomepa8beP8AuQc6eXt5FriJwfFMwQx2v2f9mCL

$2.150000

0.008911 JitoSOL

+0.40% (24h)

Market Cap

$769,351,849

Liquidity

$6,061,831

Holders

75,889(Top 10: 50.13%)

Blockchain

Solana

Contract Address

jtojtomepa8beP8AuQc6eXt5FriJwfFMwQx2v2f9mCL

AGE

1 years (Dec 7, 2023)

DEXes

Orca, Meteora, Raydium

About JITO

JITO token originates from its liquid staking pool service on the Solana network, where the official stated it would reimagine block building and value creation. Through this staking pool, users can participate in on-chain block building processes and earn MEV rewards.

JITO (JTO) jtojtomepa8beP8AuQc6eXt5FriJwfFMwQx2v2f9mCL is a 1 years old token on the Solana blockchain. Current price: $2.150000 (+0.40% 24h). Market cap: $769,351,849. Liquidity: $6,061,831. Contract: jtojtomepa8beP8AuQc6eXt5FriJwfFMwQx2v2f9mCL. Tracked on CoinMarketCap, CoinGecko, Dexscreener. Traded on Orca, Meteora, Raydium.

Key Factors & Recent Activity 2025-07-22T15:07:49

- JITO is a Solana token launched in 2023 with a cool staking promise (earn rewards when you stake).

- Recent news shows they focus on liquid staking and MEV, drawing steady user interest.

- Trading happens on many places with over $130M traded in one day, which means lots of movement.

- Its risk score is moderate (40) and there are a couple of small rug pull alerts, but it’s audited.

- Liquidity across major Solana DEXs looks healthy, yet slight volatility is seen in short-term price moves.

- The team is active on Twitter and Telegram, hinting at a supportive community. So, while the project shows interesting innovation and decent trading activity, red flags are waving a bit—watch closely and be very cautious. If you enjoy a bit of risk for potential upside, it might be an opportunity to keep an eye on, but don't get too excited just yet.

Disclaimer: Information provided is for general purposes only and not financial advice. Meme tokens can be highly volatile. Always do your own research (DYOR).

Visit Official Website →JTO/JitoSOL Price Chart

| Timeframe | Price Change | Volume (USD) |

|---|---|---|

| 5 Min | +0.00% | $0.00 |

| 1 Hour | +0.47% | $2,234.51 |

| 6 Hours | -0.23% | $15,392.68 |

| 24 Hours | +0.40% | $296,907.77 |

Statistics

Market Cap

$769,351,849

Volume (24h)

$933,980.05

Fully Diluted Valuation (FDV)

$2,159,326,370

Circulating Supply

356,292,444

Total Supply

1,000,000,000

Max Supply

1,000,000,000

Holders

75,889+

All Time High (ATH)

N/A

All Time Low (ATL)

N/A

Buyers & Sellers Overview

| Timeframe | Net Buyers | Total Traders | Buyers | Sellers |

|---|---|---|---|---|

| 5 Min | -4 | 4 | 0 | 4 |

| 1 Hour | +12 | 176 | 94 | 82 |

| 6 Hours | -87 | 755 | 334 | 421 |

| 24 Hours | -743 | 6,493 | 2,875 | 3,618 |

Net Buyers = Number of buyers minus sellers. Data summed across all available pairs for this token.

Listed On

Trackers:

DEX Markets:

Trading Pairs for

jtojtomepa8beP8AuQc6eXt5FriJwfFMwQx2v2f9mCL

DEX: Orca

Pair With: JTO/JitoSOL

Liquidity: $6,061,831

DEX: Meteora

Pair With: JTO/USDC

Liquidity: $201,218

DEX: Orca

Pair With: JTO/SOL

Liquidity: $131,902

DEX: Raydium

Pair With: JTO/SOL

Liquidity: $230,053

DEX: Orca

Pair With: JTO/JitoSOL

Liquidity: $241,532

DEX: Orca

Pair With: JTO/USDC

Liquidity: $145,929

DEX: Meteora

Pair With: JTO/JitoSOL

Liquidity: $80,424

DEX: Raydium

Pair With: JTO/USDC

Liquidity: $32,624

DEX: Raydium

Pair With: JTO/SOL

Liquidity: $22,358

DEX: Meteora

Pair With: JTO/SOL

Liquidity: $27,315

DEX: Orca

Pair With: JTO/USDC

Liquidity: $9,824

DEX: Orca

Pair With: JTO/SOL

Liquidity: $11,821

DEX: Meteora

Pair With: JTO/USDC

Liquidity: $5,551

DEX: Meteora

Pair With: JTO/SOL

Liquidity: $4,617

DEX: Meteora

Pair With: JTO/SOL

Liquidity: $3,025

DEX: Meteora

Pair With: JTO/USDC

Liquidity: $1,307

DEX: Orca

Pair With: JTO/RAY

Liquidity: $1,168

DEX: Meteora

Pair With: JTO/SOL

Liquidity: $1,178

DEX: Raydium

Pair With: JTO/USDC

Liquidity: $261

DEX: Raydium

Pair With: JTO/SOL

Liquidity: $107

DEX: Orca

Pair With: JTO/USDT

Liquidity: $170

DEX: Meteora

Pair With: JTO/Bonk

Liquidity: $83

DEX: Raydium

Pair With: JTO/SOL

Liquidity: $2

DEX: Raydium

Pair With: JTO/SOL

Liquidity: $1

DEX: Raydium

Pair With: JTO/SOL

Liquidity: $1

DEX: Meteora

Pair With: JTO/SOL

Liquidity: $0

DEX: Meteora

Pair With: JTO/USDT

Liquidity: $5

DEX: Raydium

Pair With: JTO/SOL

Liquidity: $0

DEX: Raydium

Pair With: JTO/JTO

Liquidity: $693,550

DEX: Orca

Pair With: JTO/JTO

Liquidity: $417,020

Community Mentions For #JTO

18,199 followers · Jul 22, 2025, 9:48 AM

49,549 followers · Jul 22, 2025, 8:28 AM

梭哈Ai 的第91天

Virtual aixbt wld lpt

昨天晚上发的感觉要回调了,结果真回调

第一个抄底时间看7.23号早上4点左右

这次轮动主要是Defi 板块的上涨

Ai和meme都没有涨多少

等下波轮动的

重点还要关注sol生态

抄底大币种先sol在是ray jup jto 这些

0 followers · Jul 22, 2025, 8:00 AM

编译:深潮TechFlow

随着 Solana 的代码问题在过去几年中逐步得到解决,区块时间(即网络生成新交易区块所需的时间)显著减少,甚至低于其标称的 400 毫秒。

然而,在过去一个月中,出现了一个有趣的趋势:中位区块时间(区块链网络中一个关键的性能指标,反映区块链网络处理交易和生成区块的速度)激增,Solana 添加新交易到区块链的速度变慢。原因在于一种新的验证者策略,这表明缓慢生成区块可能更具收益性。据 Blockworks 报道,Anza、Jito 和 Marinade 正在考虑解决这一问题。

每个 Solana 区块都有一个验证者担任领导者角色——负责收集交易、创建区块并将其广播到网络。领导者通过创建区块收取交易费用。更多的订单流意味着更多的费用机会,因此验证者可能会选择处理 500 毫秒的交易,而不是 300 毫秒,以增加收益。

从基本层面来看,一些 Solana 验证者似乎在尽可能长时间地等待,以便将更多交易打包进区块,从而最大化收益。这种行为导致了 Solana 的周期长度增加。

对于一个致力于像纳斯达克一样快速的网络来说,这显然不是理想的情况。此外,周期减少意味着质押奖励的复利机会减少,这一点由 Sol Strategies 的首席技术官 Max Kaplan 提出。

Solana 提供了一种称为“宽限滴答”(grace ticks)的机制,这是一个允许领导者仍然能够成功提交区块的延迟期。这一机制旨在防止远程位置的验证者受到不公平的惩罚,但也为验证者故意延迟提交区块打开了大门。

此外,Solana 的替代客户端 Frankendancer 最近发布了一个收入最大化的调度器。

据 Kaplan 透露,运行该客户端的验证者似乎正在以稍慢于正常的速度打包区块。不过,Kaplan补充道,与更严重的延迟者相比,Frankendancer 的延迟可以忽略不计,他并不认为这是一件“坏事”。此外,在权益证明区块链上,区块延迟并不是一个新概念。然而,Firedancer 的升级可能让这一策略在 Solana 上变得更加显眼。Jump 尚未对此发表评论。

有趣的是,Firedancer 软件工程师 Michael McGee 在本周的 Lightspeed 播客中描述了这一现象。他提到:“我们在当前的验证者中看到的一件事是...[验证者]往往通过延迟交易执行来创建更有利可图的区块。”

Blockworks Research 分析师 Victor Pham 指出,那些更明显延迟区块的 Solana 验证者通常运行的是 Agave-Jito 客户端的修改版本。

例如,在 6 月中旬的第 802 周期中,Galaxy 和 Kiln 的中位区块时间均超过了 570 毫秒。根据 Solana Compass 数据,一些未标记的验证者运行速度也较慢,而 Temporal 的验证者中位区块时间为 475 毫秒。

Kiln联合创始人Ernest Oppetit承认,其验证者——Solana网络中第六大质押验证者——曾在一段时间内延迟区块插槽,但表示目前已停止这种行为。

“在Kiln,我们以提供市场上最高的质押年收益率(APY)为荣,同时不牺牲安全性。我们一直在对技术栈的不同部分进行研发,包括时间策略,并与客户、客户端团队以及基金会保持持续讨论。目前,我们遵循规范,不再延迟区块,但许多其他验证者仍在这样做。我们认为最终需要在协议层面解决激励问题(快速生成区块导致奖励减少),”Oppetit 说道。

Temporal 工程总监 Ben Coverston 在被问及其验证者显然参与缓慢区块趋势时表示:“我可以说,我们并不是让人们了解这一现象的原因。”

Galaxy的一位发言人则表示:“作为服务提供商,我们支持能够优先最大化客户质押奖励的验证者配置。在 Solana 上,这可能意味着提议稍慢的区块以确保更高的奖励获取。Galaxy也一直响应社区反馈,并已将区块时间调整至可接受的范围内。”

然而,Solana 验证者社区普遍认为减慢网络速度并不合适,缓慢的验证者目前正面临公众的强烈反对。

他们可能很快会面临更实质性的惩罚。据 Blockworks 报道,Jito 计划将缓慢验证者从其质押池中列入黑名单,而该质押池是 Solana 网络中规模最大的。

Jito 基金会主席 Brian Smith 表示,该组织正在“起草一项治理提案,赋予一个委员会权力,从 JitoSOL 委托集合中移除落后者。这项提案应该会在几天内向社区开放讨论。”

Marinade 的联合创始人 Michael Repetny 表示,该质押池提供商正在“考虑将此问题提交治理提案,以讨论将[缓慢验证者]作为硬性规则/委托策略违规行为的利弊考量。”

协议层面的解决方案也正在推进中。Anza 的 GitHub 仓库显示了一项新提案,建议将Solana的宽限滴答期缩短一半。此外,Solana 提出的共识机制改革也有望解决这一问题。

“Alpenglow 将通过启用跳过投票功能来解决这个问题,”Anza 核心工程副总裁Brennan Watt 表示。

Watt 在最近一期的 Lightspeed 播客中透露,Anza 希望在今年 12 月的 Solana Breakpoint 大会之前让 Alpenglow 上线主网。

7,349 followers · Jul 22, 2025, 5:21 AM

if you understand the SOL thesis, you should also understand the JTO thesis.

11,926 followers · Jul 22, 2025, 3:10 AM

21,354 followers · Jul 22, 2025, 2:37 AM

We go $SOL $JTO $BONK $FARTCOIN $WIF $POPCAT

103,670 followers · Jul 22, 2025, 2:07 AM

相比较 $ETH $BNB $XRP 从ATH下来后的反弹幅度, $SOL 的确是有补涨空间的。

今天 $RAY $JUP $JTO $KMNO 都在冲刺,另外还有一个非常有意思的风向标 $FARTCOIN ,懂的人都知道这个屁币作为行情判断有多灵 😂😂

如果打算涨中做涨整短线的不建议追多个标的,踏踏实实找好你熟悉的,注意设置好止损。

326,580 followers · Jul 22, 2025, 1:52 AM

7,032 followers · Jul 21, 2025, 9:54 PM

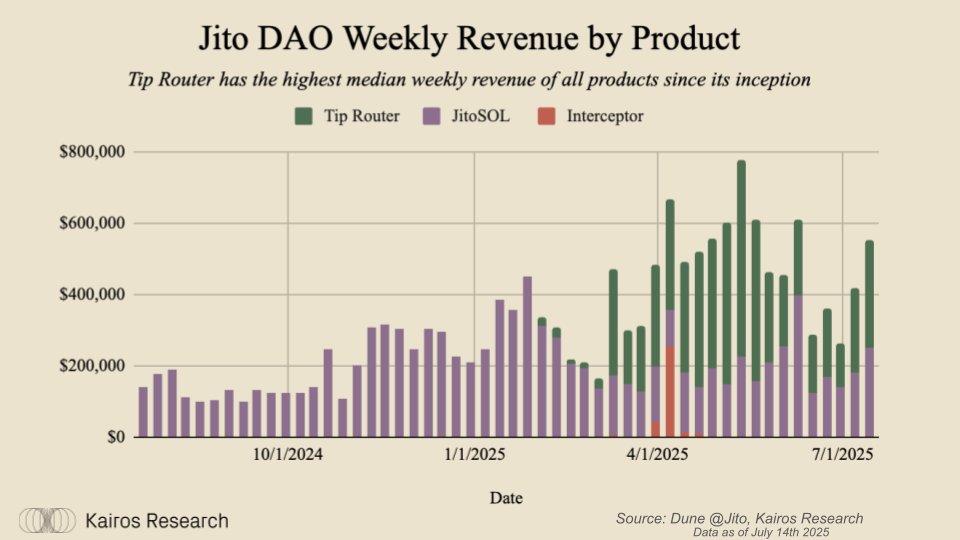

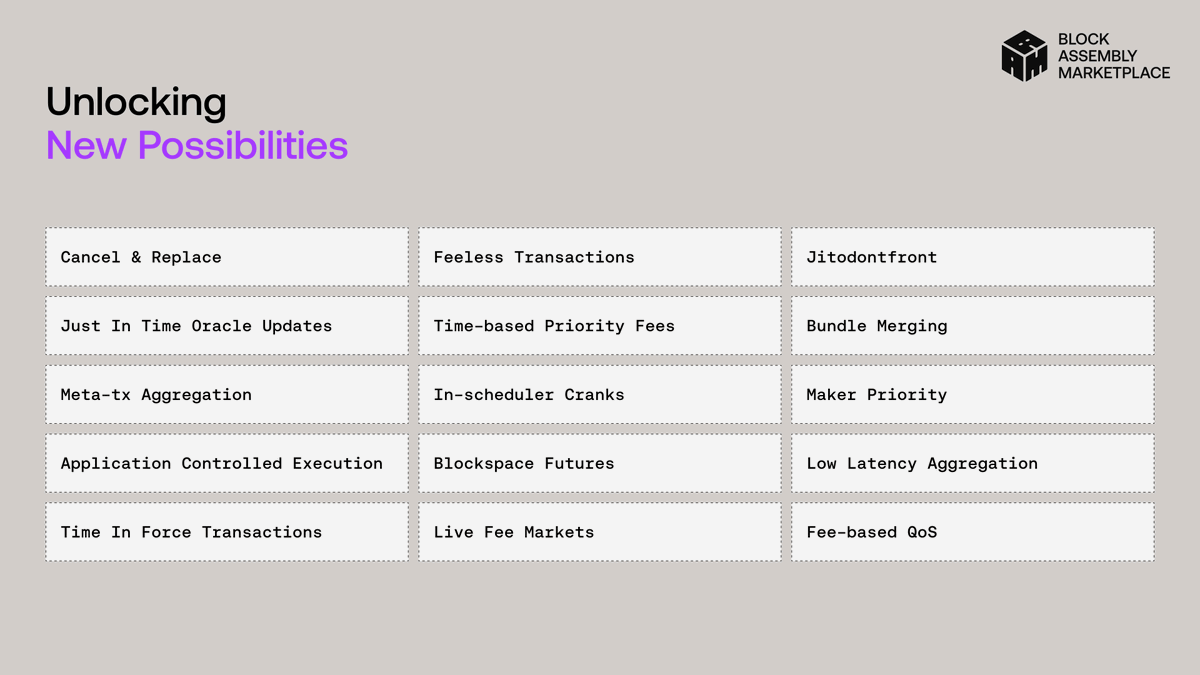

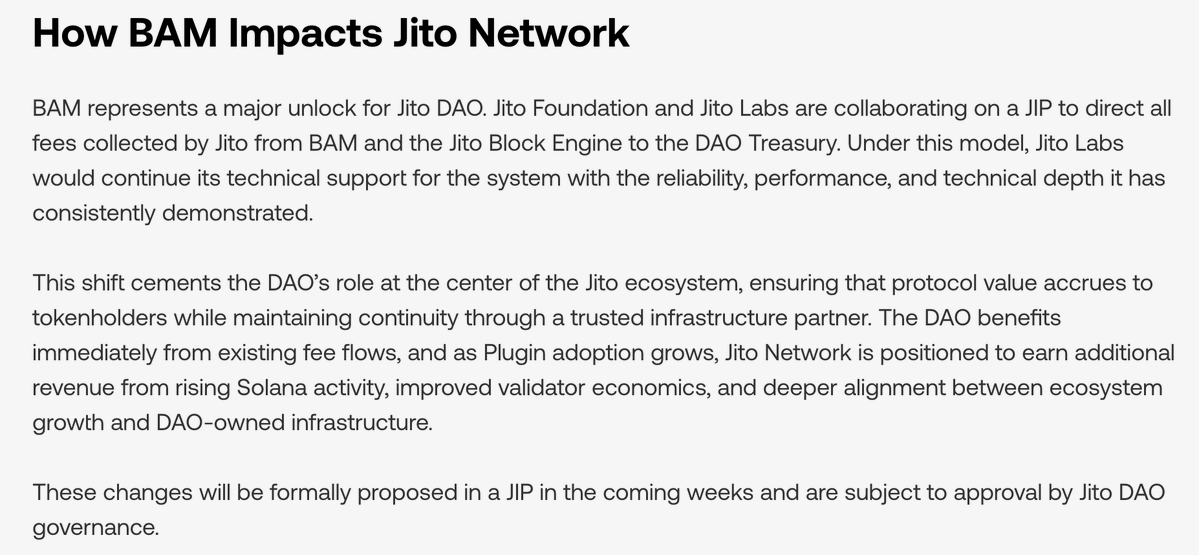

Jito just unveiled their most important product to date, and while there is lots to unpack from the product standpoint - an important market catalyst was revealed:

"Jito Foundation and Jito Labs are collaborating on a JIP to direct *all fees* collected by Jito from BAM and the Jito Block Engine to the DAO Treasury."

Currently, the DAO and Jito Labs split a collective 6% take rate on tips 50/50 (3% each), but this upcoming proposal would change that, directing all value towards the DAO.

Using the current 30, 60, and 90 day moving averages, along with the median daily tip amount over the last year, the 6% take rate on Tips annualizes to the following:

30-D: $27,820,634

60-D: $25,876,009

90-D: $35,457,431

Median 1-Y: $39,912,695

In addition, the median weekly JitoSOL staking reward fee annualizes to an additional $9.3m for the DAO. Add in interceptor, a lesser known product, and the DAO is looking at approximately $45m-$50m in annual revenue for the DAO.

Directing 100% of take rates on fees are set to bolster Jito's strongest existing revenue stream.

On BAM:

We will share some deeper thoughts within an upcoming research report, but our high level takeaway is that Jito's success has always come from obsessing over improving the user experience on Solana, and this is continued progress in that direction.

They made a controversial decision in the past to deprecate their mempool, only to see that decision lead to a surge of activity on the network.

And while moving away from an incumbent solution with a dominant market share is bold, we believe the continued desire to improve overall network functionality will, in hindsight, once again prove obvious for driving increased user activity.

With BAM Jito is offering protocols an opportunity to enable more efficient, transparent, and decentralized block-building via plug-ins.

We believe this will boost revenue and unlock a new wave of value creation for all stakeholders.

In Summary, we several postiive tailwinds for Jito right now

- Staked SOL ETFs

- SubDAO on Token-Economics funded

- 100% of Revenue going to the DAO (full alignment)

- and now the Block Assembly Marketplace (BAM)

We are excited to share more of our thoughts on all these topics in our upcoming research report.

Be sure to follow and subscribe to our substack so you can get it first!

KMNO

0.06269311

1.2 yr

CUDIS

0.06258732

2 MOn

UPTOP

0.03831628

30 Days

BUNK

0.00089732

29.7 Days

ERC-69

0.00537119

1 MOn